Understanding Forex Position Trading: Strategies for Success

Forex position trading is one of the most rewarding trading styles, allowing traders to capitalize on long-term trends in the foreign exchange market. Unlike day trading or swing trading, which focus on short-term price movements, position trading relies on fundamental analysis, macroeconomic factors, and technical indicators to forecast currency movements over a period ranging from weeks to months, and even years. Position traders often focus on the fundamental story behind a currency pair, incorporating various factors such as interest rates, economic reports, and geopolitical events. As traders embark on the journey of position trading, partnering with reliable brokers is crucial. For instance, forex position trading Thailand Brokers can provide valuable resources to enhance your trading strategy.

What is Position Trading?

Position trading is a long-term trading strategy where traders hold positions for an extended time frame, usually from several weeks to years. This approach contrasts sharply with day trading, where positions are opened and closed within the same trading day. Position traders aim to benefit from significant price movements in the forex market by analyzing trends and economic indicators.

When embarking on position trading, it is crucial to understand that this strategy relies heavily on the broader economic landscape. Position traders tend to focus on macroeconomic conditions, central bank policies, and geopolitical developments, making it essential to stay informed about global events that can impact currency values.

Key Characteristics of Position Trading

Position trading comes with distinct characteristics that set it apart from other trading styles. Here are some of the key features:

- Long-Term Focus: Position traders hold their trades for weeks, months, or even years, allowing them to benefit from major price movements.

- Fundamental Analysis: This trading style relies heavily on fundamental analysis, considering macroeconomic indicators, interest rates, and geopolitical situations.

- Less Frequent Trading: Position traders trade less frequently than day or swing traders, which can help reduce transaction costs and psychological stress.

- Patience is Key: Successful position trading requires patience, as traders must wait for their analysis to play out over time.

- Risk Management: Even though trades are held longer, employing robust risk management strategies, such as stop-loss orders and position sizing, is essential.

Strategies for Successful Position Trading

To become a successful position trader, it is crucial to adopt effective strategies that align with the long-term nature of this approach. Here are several strategies that can help:

1. Analyzing Economic Indicators

Economic indicators such as GDP growth, unemployment rates, inflation, and interest rates play a significant role in currency valuation. Position traders should monitor these indicators closely, as they can provide insights into the potential strength or weakness of a currency.

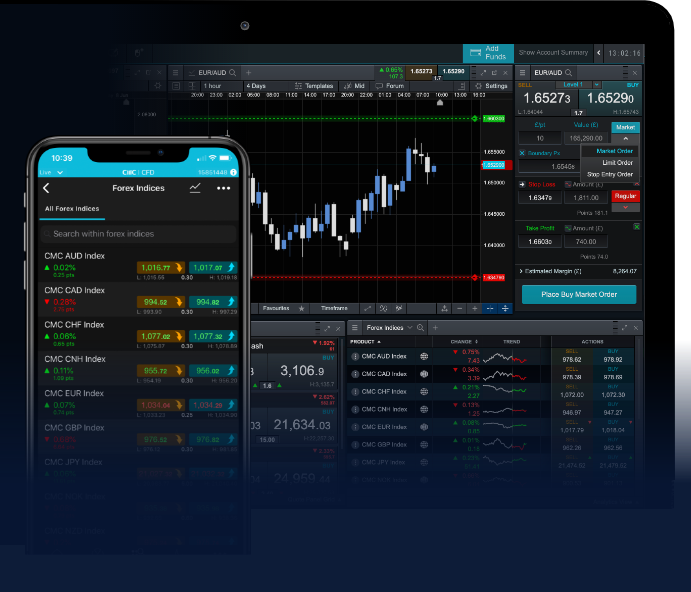

2. Technological Analysis

While position trading is primarily based on fundamental analysis, incorporating technical analysis can enhance decision-making. Traders can use chart patterns, moving averages, and trend lines to identify entry and exit points based on historical price movements.

3. Diversifying the Portfolio

Diversifying a trading portfolio across various currency pairs can help mitigate risks associated with specific currencies. Position traders should consider diversifying their positions to weather unexpected events that may impact individual currencies.

4. Using Stop-Loss Orders

To protect against significant losses, position traders should always employ stop-loss orders. This risk management technique ensures that traders exit a position if the price moves unfavorably beyond a predetermined point.

5. Stay Informed on Global Events

Being informed about global events and economic shifts is vital for position traders. Regulatory changes, political events, and economic crises can dramatically affect currency values. Regularly consuming financial news and analyses can help traders anticipate market movements.

The Importance of Discipline and Patience

One of the most critical aspects of successful position trading is maintaining discipline and patience. Since position traders hold their trades for extended periods, it is essential to stick to their trading plan and avoid knee-jerk reactions based on short-term market fluctuations. Traders need to recognize that the forex market can be influenced by myriad factors, and it may take time for their analysis to yield results. Emotional decision-making can lead to costly mistakes, so staying focused on long-term objectives is paramount.

Common Mistakes in Position Trading

Like any trading strategy, position trading comes with its pitfalls. Here are some common mistakes that traders should avoid:

- Neglecting Risk Management: Failure to employ proper risk management strategies can lead to catastrophic losses.

- Overtrading: While position trading involves fewer trades, some traders may still engage in overtrading due to impatience, which can erode profits.

- Ignoring Fundamentals: Relying solely on technical analysis without considering fundamental factors may lead to poor decision-making.

- Lack of an Exit Strategy: Not having a well-defined exit strategy can lead to missed profit opportunities or substantial losses.

Final Thoughts

Forex position trading offers an opportunity for traders to benefit from long-term trends while relying on fundamental and technical analysis. By understanding the intricacies of this trading style and developing effective strategies, traders can increase their chances of success in the forex market. It is essential to remain disciplined, patient, and informed, as these attributes are key to navigating the complexities of position trading. Remember that every trader’s journey is unique, and continuous learning and adaptation to the evolving market landscape are crucial for long-term success.

评论0